法兰克福/杜塞尔多夫,德国(路透社)— 当地时间2月12日,瑞士电梯制造商迅达集团董事Alfred Schindler告诉路透社,迅达集团将在法庭上以反垄断为由,展开攻势,拖延蒂森克虏伯的电梯业务部门与通力集团之间的任何交易。

在蒂森克虏伯电梯业务竞标截止日的第二天,Alfred Schindler发出此番言论。而在这次竞标中,来自芬兰的通力集团和其他三组私募公司联合体都提出了报价,据称这笔交易的价值可能高达170亿欧元(约186亿美元)。

可以预见,通力集团和蒂森克虏伯电梯公司一旦合并,将一跃成为全球最大的电梯制造商,把目前全球排名第一的美国联合技术公司(UTC)旗下的奥的斯电梯公司和第二的迅达集团甩在后面。

迅达集团名誉主席Alfred Schindler说:“我们可能会在欧洲、美国、加拿大、中国甚至澳大利亚提起诉讼。这些诉讼案至少要三到四年才会结案。”。

他还提到,如果蒂森克虏伯集团把电梯业务出售给通力集团,希望其他竞争对手也采取相应的法律手段。他说:“你可以想象到,奥的斯和迅达集团都绝不会这么轻易地接受被踢出局。”

对此,蒂森克虏伯集团拒绝评论。通力集团和奥的斯也未即时作出回应。

蒂森克虏伯集团曾是德国制造业的象征,如今因多年投资失败,负担着124亿欧元的债务及养老金负债,不得不出售其最有盈利价值的电梯业务以进行融资。

蒂森克虏伯集团计划在二月底做出具体决策。除了整体或部分出售电梯业务以外,他还计划进行IPO上市,尽管消息称实施上市的可能性不大。

如果把电梯业务全盘出售给通力集团,蒂森克虏伯集团很可能会获得最多的资金用以缓解当前的困难。但同时它也担心此次交易可能会触发多个市场的反垄断调查,因为整合后的公司将成为这些市场的主导者。

如果通力集团赢得竞标,那这次交易将在欧洲和美国引起漫长的反垄断审查,甚至需要向竞争对手出售部分资产以通过审查。

Alfred Schindler曾在1985年至2011年任迅达集团CEO,他的话在目前仍然很有分量。

Schindler和Bonnard家族及有关利益方,持有迅达集团71.1%的投票权。

Alfred Schindler在位时,把迅达集团从一家瑞士本土公司打造为全球性公司,他称除了法律手段外,迅达集团还会加强营运力度,与两个竞争对手的合体进行抗衡。他没提及任何细节,说道:“技术战争即将展开。现在已经开始了,但将会更加激烈。防御策略的核心就是出其不意。提前布置战术则可以无视战争规则。”

FRANKFURT/DUESSELDORF, Germany (Reuters) – Swiss elevator maker Schindler (SCHP.S) would embark on an all-out antitrust offensive in the courts to stall any deal to combine Thyssenkrupp’s (TKAG.DE) lift division with rival Kone (KNEBV.HE), board member Alfred Schindler told Reuters.

His comments came a day after the deadline for binding bids for Thyssenkrupp Elevator, which Finland’s Kone and three private equity consortia are looking to buy in a deal sources say could be worth up to 17 billion euros ($18.6 billion).

A combination of Kone and Thyssenkrupp Elevator would create the world’s largest lift maker, leapfrogging the market leader Otis, which is owned by United Technologies’ (UTX.N), and Schindler, currently in second place globally.

“We would probably file lawsuits in Europe, the United States, Canada, China and possibly Australia. These cases would take at least three to four years,” Schindler, who currently serves as the Swiss company’s chairman emeritus, said.

He said he would expect other rivals to take legal action in the event of a sale to Kone: “You can safely assume that neither Otis nor Schindler will simply accept being driven out.”

Thyssenkrupp declined to comment. Kone and Otis did not immediately respond to requests for comment.

once a symbol of Germany’s industrial power, Thyssenkrupp is struggling with 12.4 billion euros of debt and pension liabilities after years of ill-fated investments and needs to raise money from its prized elevator division.

Thyssenkrupp plans to make a decision on what it will do with the business by the end of February. Besides a full or partial sale, it is also pursuing plans for an initial public offering, though sources said this was becoming less likely.

While an outright sale to Kone would probably raise the most cash for the beleaguered conglomerate, Thyssenkrupp is concerned it might trigger antitrust investigations in a number of markets where the combined company could become a dominant player.

If Kone is selected, the deal is expected to result in lengthy antitrust reviews in Europe as well as the United States which could lead to the sale of some assets to rivals to secure regulatory approval.

Having served as the company’s CEO from 1985 until 2011, Schindler’s assessment carries significant weight, while the Schindler and Bonnard families, and parties related to them, hold 71.1% of the company’s voting rights.

Schindler, who transformed the Swiss company into a global player, said besides legal steps, it would also intensify its operational efforts to fight any tie-up between the two rivals.

“There will be a technology war. It is already ongoing but it will intensify massively,” Schindler said, without providing any specifics.

“Surprise lies at the heart of any defense strategy. A strategy that you lay out in advance would go against any rule of warfare.”

恒达富士电梯

恒达富士电梯 森赫电梯

森赫电梯 西柏思

西柏思 康力电梯

康力电梯 巨龙电梯

巨龙电梯 莱茵电梯

莱茵电梯 江南嘉捷电梯

江南嘉捷电梯 升华电梯

升华电梯 奥的斯电梯

奥的斯电梯 远大智能博林特电梯

远大智能博林特电梯 开门红〡远大集团双月斩获13.6亿新订单,销售铁军全球攻坚战果累累

开门红〡远大集团双月斩获13.6亿新订单,销售铁军全球攻坚战果累累 恒达富士电梯2025年总结大会暨感恩答谢晚宴圆满举行

恒达富士电梯2025年总结大会暨感恩答谢晚宴圆满举行 恒达富士电梯2024年大事记

恒达富士电梯2024年大事记 智慧创新 砥砺前行 新电梯网电梯智能制造、更新改造新年座谈会在佛山成功举办

智慧创新 砥砺前行 新电梯网电梯智能制造、更新改造新年座谈会在佛山成功举办 LINVOL领沃无障碍计划全国点亮行动正式启动

LINVOL领沃无障碍计划全国点亮行动正式启动 沙特海湾博林特合资工厂正式启航! | 博林特电梯,践行“走出去”策略,彰显“中国制造”实力

沙特海湾博林特合资工厂正式启航! | 博林特电梯,践行“走出去”策略,彰显“中国制造”实力 为国庆献礼 | 博林特电梯270台单次发货新记录,向世界展现中国制造力量!

为国庆献礼 | 博林特电梯270台单次发货新记录,向世界展现中国制造力量! 中国经济的信心丨升华电梯坚定走好国际化企业集团之路

中国经济的信心丨升华电梯坚定走好国际化企业集团之路 江南嘉捷电梯-电梯系列

江南嘉捷电梯-电梯系列 苏州莱茵电梯

苏州莱茵电梯 西柏思V70 不带井道轿厢式电梯星际版,豪华轿厢电梯

西柏思V70 不带井道轿厢式电梯星际版,豪华轿厢电梯 恒达富士电梯2019廊坊展台

恒达富士电梯2019廊坊展台 2023中国电梯展-康力电梯

2023中国电梯展-康力电梯 2023中国电梯展-宁波欧菱

2023中国电梯展-宁波欧菱 2023中国电梯展-艾米尼奥

2023中国电梯展-艾米尼奥 2023中国电梯展-伟邦科技

2023中国电梯展-伟邦科技 平层开关

平层开关 钣金加工,不锈钢加工,涂装设备,激光切割,五金加工

钣金加工,不锈钢加工,涂装设备,激光切割,五金加工 电梯配件,五金加工,激光切割,钣金加工,涂装设备

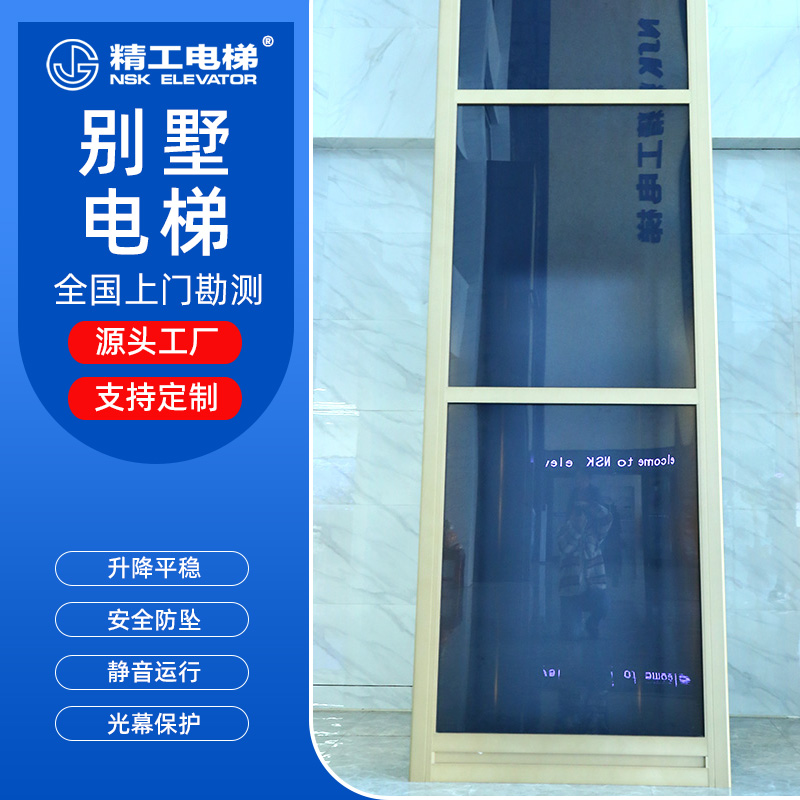

电梯配件,五金加工,激光切割,钣金加工,涂装设备 山东精工家用别墅电梯|载货电梯|乘客电梯|医用电梯|观光电梯

山东精工家用别墅电梯|载货电梯|乘客电梯|医用电梯|观光电梯 电梯配件,涂装设备,激光切割,五金加工

电梯配件,涂装设备,激光切割,五金加工 电梯安装,电梯加装,别墅电梯,家用电梯,淄博电梯

电梯安装,电梯加装,别墅电梯,家用电梯,淄博电梯 加装电梯

加装电梯 乘客电梯

乘客电梯 加装电梯外玻璃

加装电梯外玻璃 警铃按钮检修盒

警铃按钮检修盒 通力电梯配件圆形按钮2G02 J80

通力电梯配件圆形按钮2G02 J80 通力电梯配件点阵外呼显示板

通力电梯配件点阵外呼显示板 通力电梯配件抱闸模块

通力电梯配件抱闸模块 通力电梯配件

通力电梯配件 通力电梯配件

通力电梯配件 通力电梯配件门刀

通力电梯配件门刀 液压家用电梯室内外小型观光液压电梯二层三四层别墅电梯

液压家用电梯室内外小型观光液压电梯二层三四层别墅电梯 家用别墅电梯 厂家直供 无机房曳引电梯小型二三四五层复式阁楼电梯

家用别墅电梯 厂家直供 无机房曳引电梯小型二三四五层复式阁楼电梯 电梯安装,电梯加装,别墅电梯,家用电梯,淄博电梯

电梯安装,电梯加装,别墅电梯,家用电梯,淄博电梯 别墅电梯

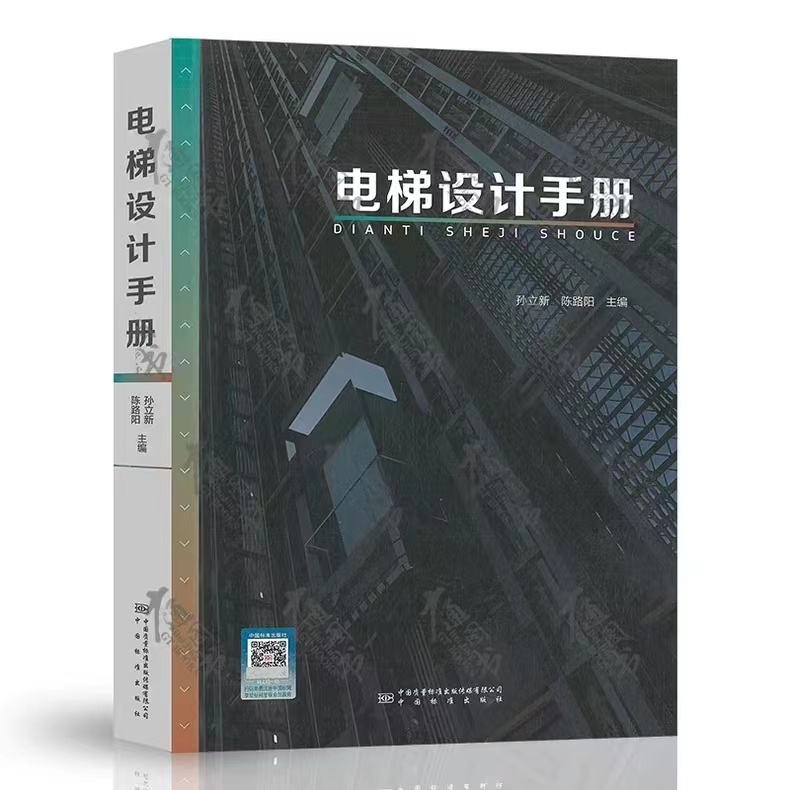

别墅电梯 电梯设计手册

电梯设计手册 《电梯制造与安装安全规范第1部分:乘客电梯和载货电梯》

《电梯制造与安装安全规范第1部分:乘客电梯和载货电梯》 新安全标识躺下型蜷缩型站立型对重缓冲器最大允许距离不干胶

新安全标识躺下型蜷缩型站立型对重缓冲器最大允许距离不干胶